Retail Alliance and ABNB FCU Launch Innovative Program to Support Growing Retail Businesses

Retail Alliance, in partnership with ABNB Federal Credit Union, NuMarket, the Hampton Roads Small Business Development Center (SBDC), and other key collaborators, has launched the Hampton Roads Retail Catalyst, a groundbreaking pilot program aimed at supporting new and existing small business retailers to thrive and scale.

This program will provide comprehensive wraparound services, including business education, community crowdfunding proof of concept, access to capital, and ongoing technical assistance and will be piloted in Downtown Hampton Development Partnership (Settlers Landing/Bridge St), City of Portsmouth (High St), Newport News (Hilton Village) and Downtown Norfolk (Granby St).

“Small businesses are the lifeblood of our communities, yet they often face significant hurdles when trying to access capital due to limited credit history, financial resources, or collateral,” said Jennifer Crittenden, President/CEO of Retail Alliance.

"With the launch of the Retail Catalyst, our goal is to provide new and growing businesses with the resources and support they need to succeed. Through education, access to funding, and post-launch technical assistance, we’re setting retailers up for long-term success and helping to strengthen our local economy.”

A Lifeline for Small Businesses

The program offers a unique combination of resources specifically designed to meet the needs of small retail businesses:

- Education: Startups and newer retailers complete Retail Alliance’s Certificate in Retail Operations (CROps) program. More advanced retailers can work with expert panels to refine their growth strategies.

- Community Engagement: A 30-day crowdfunding campaign through NuMarket enables businesses to validate their concepts while fostering community support.

- Financing: Eligible businesses can apply for loans of up to $35,000 from a $500,000 loan pool established by ABNB Federal Credit Union, created specifically for this pilot program.

- Ongoing Support: Post-launch consulting and mentoring services from Retail Alliance and SBDC ensure businesses remain on track for long-term success.

Charles Mallon, Jr., President and CEO of ABNB Federal Credit Union, shared his enthusiasm for the initiative: “This program is a game-changer for small business owners who may not have access to traditional funding options in the past. Our $500,000 loan pool is specifically designed to meet the needs of these entrepreneurs, creating a pathway for growth that is strategic, sustainable, and impactful.”

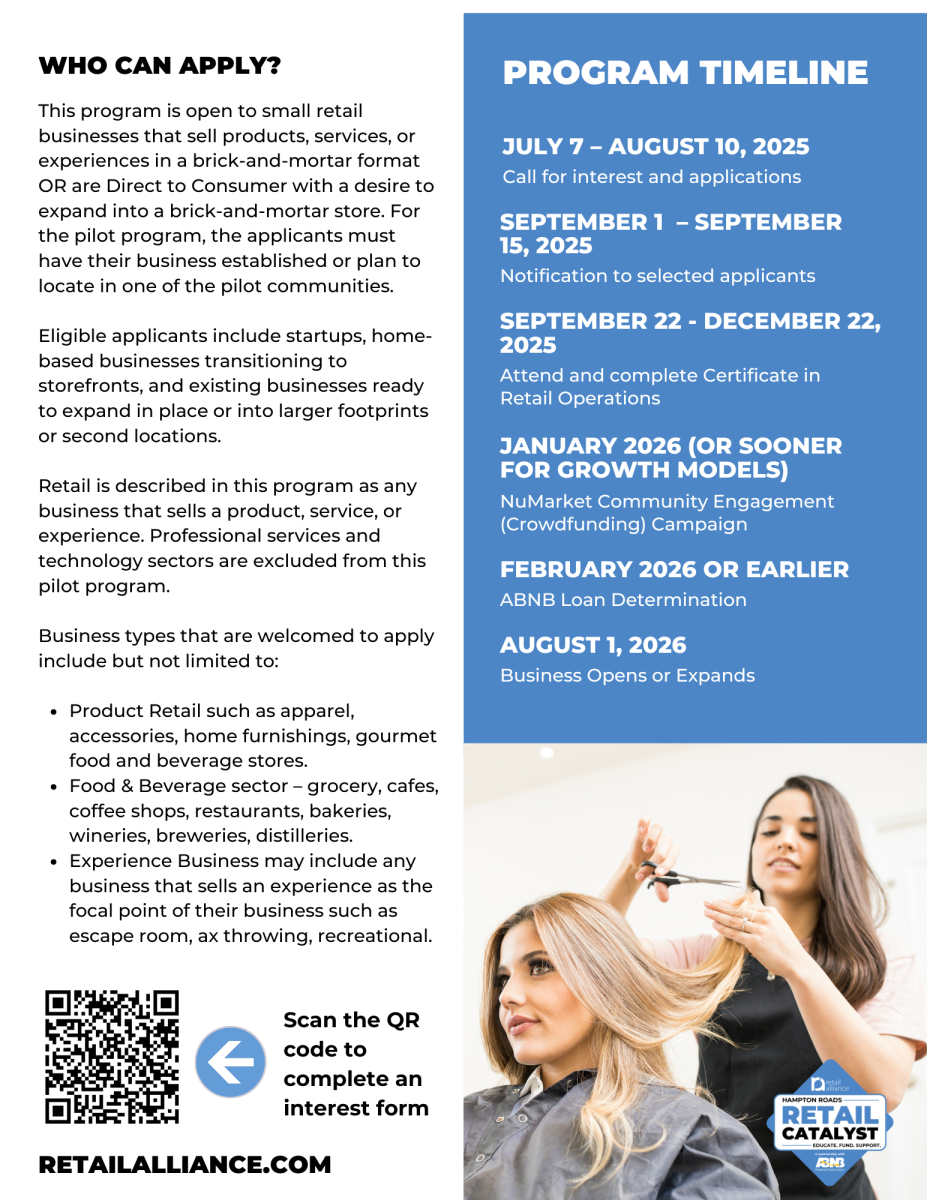

Who Can Apply?

The Hampton Roads Retail Catalyst is open to small retail businesses that sell products, services, or experiences. For the pilot program, the applicants must have their business established or plan to locate in one of the pilot communities within 6 months of completion of the program. Eligible applicants include startups, home-based businesses transitioning to storefronts, and existing businesses ready to expand. Only serious retail applicants are encouraged to apply. A strong concept, level of readiness and credit worthiness are key.

“In partnership with each community, we have done a leakage analysis to determine which retail categories are opportunities in their respective locations,” Crittenden said. “We are using this data as a tool for selecting applicants. Retail is the second highest job creator here in our region and provides a pathway to entrepreneurship. Locating these retailers in our neighborhood districts not only creates jobs but contributes to the unique identities of our communities.”

Program Timeline

- July 7-August 10 2025: Applications will be open.

- August-September 2025: Application review and selection of participants.

- Late September 2025: Start the Certificate in Retail Operations (14-week education program learning all aspects of retail operations concluding in a business plan).

- January 2026: NuMarket crowdfunding campaigns launch.

- February 2026: Loan processing through ABNB Federal Credit Union.

- Ongoing: Business openings or expansions. (Target of June 2026)

Supporting the Future of Local Retail

The Hampton Roads Retail Catalyst is more than just funding—it’s about creating a future where small retailers thrive. By integrating education, community engagement, crowdfunding, capital access, and business expertise and support, this program represents a powerful and innovative model for fostering retail success.

For more information about the Hampton Roads Retail Catalyst or to apply, visit retailalliance.com.

# # # #

About Retail Alliance

Retail Alliance has been a trusted resource for the retail industry in Hampton Roads for over a century. With a focus on education, advocacy, and community, Retail Alliance empowers local retailers to succeed. For more information, visit retailalliance.com.

About ABNB Federal Credit Union (ABNB)

ABNB Federal Credit Union is a not-for-profit, member-owned financial institution serving over 76,000 members nationwide. For more than 65 years, we've helped individuals, families, and small businesses reach their financial goals. With 14 branches across Hampton Roads and northeastern North Carolina, plus nationwide access to service centers and surcharge-free ATMs, ABNB offers simple, secure, and accessible banking. Enjoy better rates, lower fees, and personalized service that puts people first. Experience the ABNB difference at ABNBfcu.org.